Introduction

For business owners, understanding the distinctions between an LLC (Limited Liability Company) and a trademark is crucial for shielding assets and establishing brand identity. LLCs offer personal liability protection, while trademarks protect your brand’s identity and market presence. This article delves into these two essential components, discussing their purposes, protection levels, registration processes, and strategic considerations. By the end, you’ll be equipped to make informed decisions about structuring your business and securing your intellectual property effectively.

Tables of Contents

Chapter 1: Navigating Legal Structures and Brand Protections: The Intersection of LLCs and Trademarks

- Exploring Legal Frameworks and Enhancing Brand Equity with LLCs and Trademarks

- The Dual Frontier of Protection: LLCs and Trademarks in Business Strategy

Chapter 2: Navigating LLCs and Trademarks: A Roadmap to Business Identity and Protection

- Foundations of Business: The Distinct Roles of LLCs and Trademarks in Safeguarding Your Venture

- LLC vs Trademark: Unraveling Essential Legal Protections for Sustainable Business Growth

Chapter 3: Navigating the Landscape of Business Protection: LLCs and Trademarks Explained

- The Distinct Safeguards: LLCs and Trademarks in Your Business Strategy

- Navigating Registration and Compliance: Your Guide to LLCs and Trademarks

Chapter 4: Navigating Legal Landscapes: The Role of LLCs and Trademarks in Business Protection

- Understanding the Legal Framework: LLCs and Trademarks in Business Strategy

- Navigating the Financial Landscape of LLCs and Trademarks for Optimal Business Growth

Chapter 1: Navigating Legal Structures and Brand Protections: The Intersection of LLCs and Trademarks

1. Exploring Legal Frameworks and Enhancing Brand Equity with LLCs and Trademarks

Understanding the distinct yet complementary roles of an LLC and a trademark is crucial for any business considering its legal and branding strategies. At a fundamental level, an LLC (Limited Liability Company) provides a legal structure that safeguards its owners’ personal assets against business liabilities. This entity functions as a protective barrier, ensuring that, in the event of business debts or legal challenges, only the LLC’s assets are at risk, effectively shielding the owners’ personal finances. In contrast, a trademark serves the vital role of protecting a brand’s identifiers—such as names, logos, and slogans—from unauthorized usage by third parties. While the LLC focuses on legal structural protection, trademarks concentrate on preserving brand identity in the marketplace.

When forming an LLC, business owners file articles of organization with their state. This process establishes the LLC as a separate legal entity, which can lead to significant benefits in terms of liability protection and taxation. The LLC structure allows for pass-through taxation, meaning that profits and losses pass through to the owners’ personal tax returns, thereby avoiding potential double taxation that can occur with corporations. Moreover, LLCs afford flexibility in management without the rigidities of corporations, which often require formal meetings and a board structure.

The legal implications of operating as an LLC are profound. Maintaining the integrity of this business structure—referred to as maintaining the corporate veil—is essential. If business and personal finances are intertwined (for instance, through commingling of funds), courts may decide to pierce the veil, exposing personal assets to business liabilities. This highlights the need for meticulous adherence to the legal formalities of LLC operation, such as keeping accurate records and properly filing taxes.

Additionally, an LLC’s name is protected only within the state of registration; this means that while other local businesses cannot operate under the same name, the name offers no protection outside that state unless additional measures, such as trademark registration, are taken. Conversely, trademark registration provides a powerful nationwide means of asserting ownership over a brand identifier. Once registered with the United States Patent and Trademark Office (USPTO), a trademark can be used across all 50 states, providing robust legal grounds against infringement and enabling the use of the ® symbol to denote registered status. This exclusivity helps prevent confusion in the marketplace and preserves the brand’s integrity.

From a business valuation perspective, the strategic use of both an LLC and trademarks can significantly enhance a company’s value. An LLC enables easier operational management and protection from liabilities, making it an appealing structure for many small business owners. On the other hand, trademarks create intangible assets that can appreciate over time. A well-recognized trademark can be an invaluable component in negotiations for loans, sales, or investments since it often represents significant market equity, distinctiveness, and customer loyalty.

Companies frequently opt to adopt both structures to leverage the benefits each offers. By establishing an LLC, business owners secure protection against personal liability, while trademarking their business name or logo enforces their brand identity and fortifies their market position against competitors. This dual strategy not only protects the enterprise’s framework but also enhances its longevity and resilience in an increasingly competitive market.

However, it is important to recognize the limitations that each structure possesses. While an LLC does not provide national name protection without trademark registration, conversely, a trademark does not offer personal liability protection. This dynamic necessitates careful consideration when planning a business strategy, as the absence of one or both protections might expose a business to significant risks.

Ultimately, the intersection of LLCs and trademarks can create a fortified business model. Properly leveraging these two mechanisms not only enhances a business’s legal protections but also solidifies its brand presence, reducing vulnerability to infringement and maximizing its potential for growth. For those considering the intricate dance between legal structure and brand equity, understanding these distinct yet parallel paths can be the key to establishing a successful, resilient business. To explore further, you can find insights on the nuances of trademark protections here.

2. The Dual Frontier of Protection: LLCs and Trademarks in Business Strategy

In the sphere of business protection, understanding the nuances between an LLC (Limited Liability Company) and a trademark is crucial for entrepreneurs and business owners alike. Each serves a distinct purpose, offering different types of protection that are fundamental to the success and longevity of a business venture. While an LLC provides a crucial legal framework for limiting personal liability and ensuring business continuity, a trademark is indispensable for safeguarding the identity and reputation of a brand in the marketplace.

At the core of an LLC’s offerings lies its ability to shield personal assets from business liabilities. By forming an LLC, business owners create a separate legal entity, effectively preventing creditors from claiming personal assets such as homes and savings in the event of business debts or lawsuits. This not only enhances the financial security of the owners but also lends credibility to the business itself. However, it is essential to recognize that LLC protection is inherently geographical; it only extends to the state where the LLC is formed. If a business operates in multiple states without registering as an LLC in each, it runs the risk of exposing both itself and its owners to potential liabilities beyond state lines.

Moreover, while LLCs bestow certain protections, they do not provide any intellectual property rights. This gap highlights a significant limitation for businesses relying solely on LLC status. A registered LLC protects the business name only within the specified state, meaning other entities in different states or different types of business structures—like sole proprietorships or partnerships—could operate under a similar name without legal repercussions, causing potential confusion among consumers. Thus, in scenarios where brand identity is paramount, the absence of a trademark can leave a business vulnerable to infringement and reputational damage.

In contrast, the role of a trademark is primarily focused on protecting the brand itself—its name, logo, and associated symbols—ensuring that the business’s identity is not only secure but also distinct within the marketplace. When registered with the United States Patent and Trademark Office (USPTO), a trademark offers powerful nationwide exclusivity against unauthorized use of similar identifiers in related commercial contexts. This protection spans all 50 states and delivers a legal presumption of ownership, making it easier to enforce rights in instances of infringement. Furthermore, the ability to litigate against parties that infringe on trademark rights provides business owners with the legal backing needed to defend their brand’s integrity.

However, it’s essential to grasp that trademark registration does come with its own limitations. Trademarks protect specific uses related to goods or services outlined in the registration and require ongoing maintenance to remain valid. If a trademarked brand is not actively used, it risks abandonment, which can be detrimental for businesses that may seek to leverage their brand for future growth or expansion. Additionally, unlike LLCs, trademarks do not offer any liability protection for personal assets or create a separate business entity.

When examining these two forms of protection side by side, the distinction becomes more pronounced. The primary purpose of an LLC is entity formation and liability limitation, while a trademark is focused on brand recognition and protection. However, both structures can—and often should—be employed together for comprehensive protection. For example, registering an LLC can be crucial for limiting financial exposure, while simultaneously pursuing a trademark can be pivotal for building brand equity and consumer trust.

This dual strategy not only fortifies personal and business assets but also sets the stage for growth opportunities such as obtaining financing against trademark rights or selling the business as a branded entity. In essence, the judicious combination of these protections forms a robust backbone for any business venture, ensuring that both the structure is sound and the brand identity is secured.

In summary, navigating the complexities of LLCs and trademarks requires a clear understanding of each’s protections and limitations. As entrepreneurs assess their business strategies, recognizing when to implement both forms of protection becomes paramount. By leveraging an LLC for personal liability protection while filing for trademark registration, business owners can establish a solid foundation upon which to build and safeguard their entrepreneurial endeavors, thus setting themselves up for sustained success in an ever-competitive landscape. For more details on trademark protections, consider diving deeper into relevant resources like trademark protection for business names and logos.

Chapter 2: Navigating LLCs and Trademarks: A Roadmap to Business Identity and Protection

1. Foundations of Business: The Distinct Roles of LLCs and Trademarks in Safeguarding Your Venture

In the landscape of business, understanding the unique roles that an LLC (Limited Liability Company) and a trademark play is crucial for any entrepreneur. Each serves a distinct purpose that is integral to the foundation and growth of a business. Understanding these roles not only facilitates informed decision-making but also helps to strategically position your venture for success by maximizing legal protections and brand authenticity.

An LLC is primarily a business structure that offers personal liability protection to its owners, known as members. This formation presents a legal barrier that separates an individual’s personal assets from those of the business. In the unfortunate event of business debts or legal actions, creditors typically cannot pursue personal assets like homes, cars, or savings accounts, underlining the LLC’s protective function. Moreover, the LLC enhances tax flexibility, allowing members to opt for various taxation methods, such as being taxed as a corporation or as individuals, helping to optimize financial outcomes. Additionally, management within an LLC can be much more flexible compared to that of corporations, as there are usually fewer formalities and no requirement for equal voting among members. Lastly, forming an LLC can bolster a business’s credibility, instilling confidence in customers, suppliers, and potential investors.

On the other hand, a trademark is a legal tool designed to protect brand identity—specifically, the unique symbols, words, or phrases that denote a company’s goods or services. In today’s competitive market, a recognizable brand is tantamount to business success; it differentiates products and establishes a connection with consumers. Trademark protection prevents unauthorized use of a business’s marks, thus shielding the entity from brand dilution and consumer confusion. By securing exclusive rights to use a trademark in commerce, a business can significantly enhance its market presence, driving brand loyalty and facilitating recognition as it navigates through diverse marketplaces.

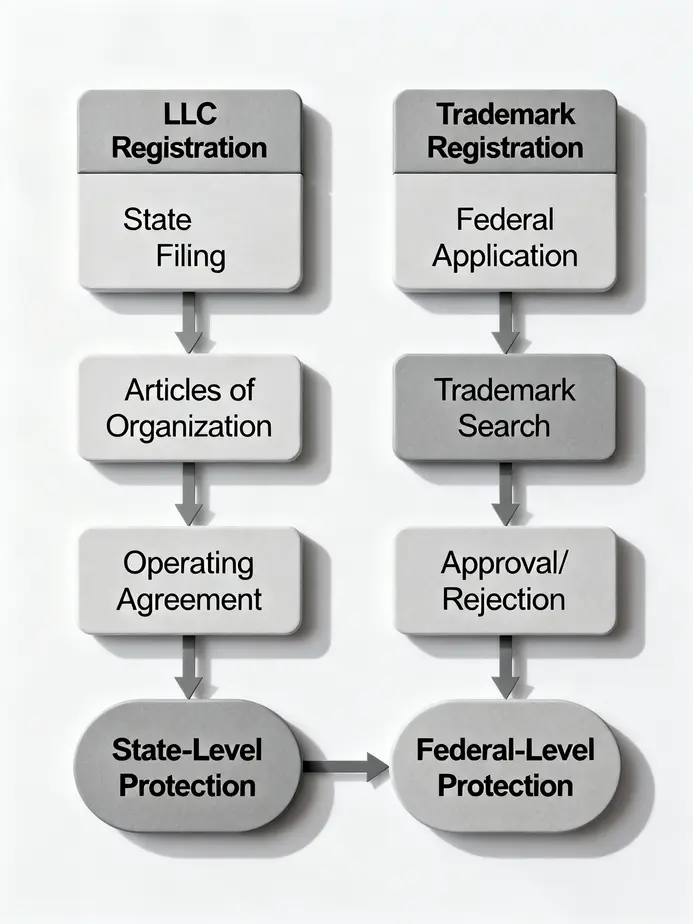

The formation processes for LLCs and trademarks merit attention as well. To establish an LLC, one must file an Articles of Organization with the applicable state, coordinating compliance with state laws and ensuring that the chosen business name aligns with legal requirements. This process typically involves crafting an Operating Agreement to delineate how the LLC will be managed. Conversely, trademark registration involves filing an application with the U.S. Patent and Trademark Office (USPTO), which may require conducting a comprehensive trademark search to confirm that the mark is not in use by another entity. Successful registration grants exclusive rights that potentially extend across the entire country, making the trademark a powerful asset in brand strategy.

Delving deeper into the key differences, we observe that while an LLC primarily safeguards personal assets and governs business management, a trademark focuses on the integrity and recognition of the business’s brand. Legal status sets them apart as well; an LLC functions as a separate legal entity whereas trademarks are categorized as intellectual property. It is also important to recognize that protection levels differ significantly: LLCs provide state-specific protections while federal trademark registration offers nationwide rights across all fifty states.

Given their complementary nature, many businesses opt to establish both an LLC and a trademark to bolster their market presence and protect their interests comprehensively. While the LLC provides a secure framework for operations and liability coverage, the trademark effectively secures the brand’s identity, ensuring that it remains recognizable to consumers. Branding is invaluable; it’s an asset that can appreciate over time, offering economic leverage through avenues such as financing or potential sales.

Bridging LLCs and Trademarks

Understanding the synergy between an LLC and a trademark highlights their respective contributions to overall business strategy. When an LLC operates under a trademark, it not only enjoys the benefits of liability protections but also elevates its brand recognition through registered marks. This dual approach enhances operational identity and promotes a cohesive narrative in all business dealings. Furthermore, trademarks owned by an LLC can be included as business assets, amplifying the entity’s valuation and attractiveness during investment rounds or acquisition discussions.

In summary, understanding the distinct roles of LLCs and trademarks is key to laying a strong foundation for any business venture. By strategically choosing both a reliable business structure and a protective brand identity, entrepreneurs can better shield their assets and create lasting value in the marketplace. The intersection of these two elements provides comprehensive security, paving the way for sustainable business growth.

2. LLC vs Trademark: Unraveling Essential Legal Protections for Sustainable Business Growth

When deciding how to safeguard your business, understanding the roles of an LLC and a trademark is paramount. An LLC, or Limited Liability Company, primarily functions as a structural shield, protecting your personal assets from the debts and liabilities that your business may incur. In contrast, a trademark serves to protect your brand identity—your business name, logo, or slogan—from unauthorized use by others, establishing your place in the market and ensuring a unique identity for your products or services. While these two legal protections serve different purposes, both are essential tools for those looking to create a sustainable and robust business.

LLC Protection and Scope

Establishing an LLC provides essential safeguards at the state level. Once you file your articles of organization and your LLC is approved, your chosen business name becomes exclusive within that state. This means that no other LLC or corporation can legally operate under that name within the same jurisdiction, thus offering you a layer of security regarding your business identity. However, it is vital to recognize the limitations of this protection; the name of your LLC is not automatically protected outside the state of registration. For instance, you could find another business operating in another state with the same name, which could lead to potential confusion for customers. Furthermore, sole proprietorships or partnerships within your state can still use your business name without facing any legal repercussions, as long as they do not operate under the LLC structure.

The limited geographic coverage provided by an LLC means that while your personal assets are better protected from business liabilities, your business name itself remains vulnerable outside your state. This context is crucial for entrepreneurs aiming to expand their operations beyond local boundaries. It suggests that merely forming an LLC should not be the end of your legal protections; considering additional measures is key.

Trademark Protection and Its Significance

On the other hand, a trademark offers a more comprehensive form of protection. When you register a trademark with the USPTO (United States Patent and Trademark Office), you secure federal protection for your brand identity. This means that your trademark is protected across all 50 states, regardless of where you conduct business. The significance of federal trademark protection cannot be overstated; it ensures that you have the exclusive rights to your brand name and logo, preventing others from using similar identifiers that could confuse consumers or dilute your brand.

Furthermore, registering a trademark establishes a legal presumption of ownership. This not only protects your brand but also allows you to defend it against infringers more effectively. If another business attempts to use your trademark or a confusingly similar name, you can pursue legal action to defend your brand’s integrity. In addition, should you ever decide to sell your business or secure loans, a trademark increases its value as an intangible asset, making it an essential factor in long-term business planning.

Why You Should Consider Both Protections

Given the distinct yet complementary roles of an LLC and a trademark, many entrepreneurs find that employing both strategies yields the best results for comprehensive legal protection. While an LLC effectively shields your personal assets from business-related liabilities and structures your business operations, a trademark ensures that your brand remains distinctive and legally protected nationwide. Simply registering your business name as an LLC does not automatically confer trademark rights. For the best protection, you must separately apply for trademark registration with the USPTO. This delineation of protections requires careful planning from business owners as they navigate the legal landscape.

It can also be beneficial to secure a state-level trademark registration alongside your LLC for added protection, especially if your business operates primarily within one state. By filing in that state, you bolster your claims to the name against others using similar identifiers in that specific jurisdiction, even if they are not formally structured as LLCs. When considering the long-term vision for your business, integrating both an LLC and appropriate trademark protections can help mitigate risks and position your brand for success in an increasingly competitive marketplace.

In conclusion, the interplay between an LLC and a trademark is vital in establishing a strong, safeguarded business. Entrepreneurs must understand the distinctions between these legal constructs to make informed decisions that support growth and protect both their personal assets and their brand identity. For further insights into protecting your business name and logo, visit this resource on trademark protection.

Chapter 3: Navigating the Landscape of Business Protection: LLCs and Trademarks Explained

1. The Distinct Safeguards: LLCs and Trademarks in Your Business Strategy

In the intricate world of business operations, understanding the protective mechanisms available is essential for entrepreneurs and companies alike. Two crucial tools exist for safeguarding assets and brand identity: Limited Liability Companies (LLCs) and trademarks. While they both offer forms of protection, their purposes, scope, and methods of registration are strikingly different and each plays a vital role in the longevity and prosperity of a business.

An LLC is primarily designed to shield its owners’ personal assets from the liabilities incurred by the business. This means that if a business faces lawsuits or cannot pay its debts, creditors can only pursue the assets linked to the LLC, not the personal belongings of its owners. This ‘corporate veil’ is a powerful feature, as it allows entrepreneurs to take business risks without the fear of devastating personal financial loss. The simplicity of forming an LLC by filing articles of organization with the state makes it a popular choice for small businesses seeking both protection and flexibility. Moreover, LLCs often benefit from pass-through taxation, meaning profits are only taxed once, at the owner’s individual tax rate rather than at the corporate level, which streamlines the financial management of the business.

On the other hand, trademarks serve a different yet equally important function — they protect branding elements such as logos, names, and slogans from unauthorized use by competitors. When a business trademark is registered with the USPTO (United States Patent and Trademark Office), it secures the exclusive right to use the trademark across the United States. This nationwide protection is paramount in preventing consumer confusion and ensuring that the brand maintains its distinct identity in the market. Importantly, even a federally registered trademark does not grant unlimited rights forever; it must be actively used and renewed periodically to sustain the protection. The process of trademark registration can be complex, often requiring applicants to navigate a thorough vetting process that verifies the uniqueness and non-infringement of prior trademarks.

Diving deeper into the scope of protection offered by LLCs versus trademarks reveals striking differences. The protection conferred by an LLC is strictly limited to the state of registration. If a business registers an LLC in California, for instance, it cannot prevent another company from utilizing the same name in Florida. This limitation highlights the necessity for many businesses to extend their protection beyond state lines, especially if they have aspirations for national expansion. In contrast, a federally registered trademark grants rights that are recognized across all 50 states. This robust protection scope is pivotal, particularly for businesses planning to market their brand outside their home state. Without this national trademark registration, a brand risks being shadowed by similar names or logos, leading to potential brand dilution or even legal disputes.

Understanding when to use each form of protection can significantly enhance a business’s risk management and branding strategy. For instance, small entities, startups, or freelancers often benefit immensely from forming an LLC to mitigate personal liability while maintaining operational flexibility and avoiding the complexities tied to corporate structures. In contrast, all businesses seeking to establish a strong brand presence should consider filing for trademarks, especially if they operate in sectors where brand identity is a substantial driver of customer loyalty and market value. Many entrepreneurs opt for both an LLC and trademark registration to create a comprehensive shield against liabilities and safeguard their intellectual property, thus reinforcing the foundation of their business.

It’s critical to note, however, that registering your business name as an LLC does not automatically grant trademark protection for that name. Businesses must undertake the separate process of registering their trademarks through the USPTO or, in some cases, with state entities. This step can be crucial for ensuring that the brand’s identity is not only legally protected but also recognized as a unique entity in the vast marketplace.

In summary, the choice between an LLC and a trademark, or the decision to utilize both, hinges upon a business’s specific needs and its future trajectory. Whether it’s protecting personal assets from business debts or securing brand identity from competitors, understanding the distinct protective roles of LLCs and trademarks is indispensable for any business strategy. Engaging with legal and industry professionals can further refine this strategy, ensuring that businesses stand resilient in both liability protection and brand integrity. For an in-depth examination of how trademarks specifically protect your business name and logo, visit Trademark2Go.

2. Navigating Registration and Compliance: Your Guide to LLCs and Trademarks

In the intricate world of business, establishing a robust legal framework is paramount. Two crucial components in this landscape are Limited Liability Companies (LLCs) and trademarks, each serving distinct yet complementary roles. This section delves into their registration processes and compliance requirements, illuminating the paths entrepreneurs must navigate to protect their interests.

When it comes to forming an LLC, the process, while generally streamlined, varies across states due to differing regulations. Firstly, business owners must select a suitable name for their LLC. This name should be unique and conform to state-specific naming conventions, ensuring it isn’t deceptively similar to existing businesses. This is a critical step as it determines not only the company’s identity but also compliance with state laws.

Following the decision on a name, the next essential step is to choose a registered agent. This agent plays a vital role as the official point of contact for legal documents and notices from the state. It could be an individual or a business entity authorized to conduct business in the state where the LLC is formed. Choosing a reliable registered agent is vital as they ensure that important paperwork is received in a timely manner, safeguarding the company’s interests.

Once these preliminary details are squared away, the formation of the LLC officially begins with the filing of articles of organization with the appropriate Secretary of State office. This foundational document typically requires basic information such as the LLC’s name, address, and the identities of its members. It is vital that this information is accurate and reflective of the actual operational structure to avoid complications that could arise from misinformation.

Moreover, drafting an operating agreement, while not always mandatory, is a best practice for LLCs. This document lays out the management structure and operational procedures of the LLC, functioning as a roadmap for its governance. Having an operating agreement mitigates potential disputes among members and clarifies responsibilities, thus enhancing internal workings.

Additionally, various licenses and permits should be obtained depending on the nature of the business. This could range from local business licenses to specific industry-related permits that are essential for lawful operation. Once the LLC is officially registered, an Employer Identification Number (EIN) from the IRS is required, especially if the LLC has employees or multiple members, facilitating tax compliance.

In the context of post-registration, ensuring compliance is crucial to retain the LLC’s good standing. Most states require LLCs to file annual reports that update any changes in member information or address. Failing to submit these reports or pay associated fees can lead to penalties or even dissolution of the business entity. Similarly, tax obligations must be adhered to — these may include local, state, and federal taxes depending on the LLC’s election to be taxed.

On another front, the significance of trademarking cannot be overstated. While an LLC protects personal assets from business liabilities, a trademark safeguards the brand identity. The process of trademark registration starts with a thorough trademark search to confirm that the desired mark is not already in use. This step is crucial in avoiding potential legal conflicts and ensuring that the mark can be uniquely associated with the business.

Once cleared, the next step is determining the basis for the trademark application: whether the mark is currently in use in commerce or if it’s intended for future use. Following this, an application must be filed with the United States Patent and Trademark Office (USPTO), accompanied by the appropriate fee. The application requires detailed information regarding the trademark itself and the goods or services it represents. This level of detail helps the USPTO assess the application efficiently.

After submission, the application undergoes examination by a trademark examiner who reviews the application to ensure compliance with relevant laws. Should any issues arise, the examiner may issue an office action requiring clarification or modification before proceeding. If everything aligns, the mark is published in the Official Gazette, allowing others to oppose the registration if they believe it conflicts with their existing rights.

It’s crucial to note that, similar to LLCs, maintaining a trademark requires diligence. Renewals are mandated every ten years, and owners must actively monitor for potential infringements to enforce their rights. Failure to use the trademark in commerce correctly can result in losing those rights, emphasizing the need for consistent and appropriate use to protect the brand.

Understanding these processes facilitates effective business strategies, enabling entrepreneurs to harness the benefits of forming an LLC and obtaining a trademark. As businesses evolve and expand, these protections provide a solid foundation for sustaining growth, safeguarding financial assets, and fortifying brand value. For further exploration of trademark protections, consider visiting Trademark Protection for Business Names and Logos.

Chapter 4: Navigating Legal Landscapes: The Role of LLCs and Trademarks in Business Protection

1. Understanding the Legal Framework: LLCs and Trademarks in Business Strategy

In the complex realm of business planning, understanding the legal structures behind an LLC (Limited Liability Company) and a trademark is essential for safeguarding not only company assets but also brand identity. While an LLC functions as a shield for personal assets against business liabilities, a trademark acts as a guardian for a business’s brand representations, including names and logos. Recognizing how these two legal instruments operate in tandem can markedly elevate a business’s strategic positioning from inception to expansion.

An LLC establishes a distinct legal entity separate from its owners, diminishing personal financial risk. This protection means that in the event of business debts, creditors cannot pursue personal assets; the liability remains confined to the LLC’s capacity. To form an LLC, one must file articles of organization with their respective state, pay associated fees, and designate a registered agent for service of process. The process might vary slightly depending on the state, highlighting the need for awareness of local regulations during setup. States demand ongoing compliance, such as submitting annual reports and maintaining name uniqueness, to retain good standing. This proactive approach helps ensure that the entity enjoys its liability protections and is compliant with corporate formalities.

However, the establishment of an LLC does not intrinsically secure a business name’s nationwide protection. While a registered LLC may prevent overlapping business entities within a single state, it does not project rights beyond that geographic boundary. For comprehensive brand protection, pursuing a trademark is crucial. A trademark offers the exclusive right to use a particular brand identifier—be it name, logo, or slogan—across all 50 states. This legal acknowledgment is pivotal for any business aspiring to differentiate itself in a crowded marketplace, thus reducing the risk of consumer confusion and brand dilution.

Trademark registration is completed through the United States Patent and Trademark Office (USPTO) or at the state level depending on the intended scope of protection. A federal trademark secures broader coverage, allowing a business to inform customers confidently of its unique offerings. Not only does this branding strategy prevent others from using similar identifiers that might mislead consumers, but it also enhances the owner’s exclusivity in the market. Businesses often overlook the importance of undergoing a thorough trademark search prior to filing, as it is essential to identify any potential conflicts with existing trademarks.

In strategic integration, one should consider LLC formation as a first step due to its immediate benefits such as liability protection and possible tax advantages; LLCs typically enjoy pass-through taxation, making them appealing for smaller operations. Once the business gains momentum and starts to scale, registering for trademarks becomes necessary to safeguard the brand’s integrity, particularly if the ambition is to operate in multiple states or venture into e-commerce where the marketplace extends beyond local borders. Failing to navigate these legal waters correctly can result in costly disputes where competitors might capitalize on similar names, unintentionally leveraging your established reputation.

It’s also critical to consider the implications of changing business structures. For owners converting a sole proprietorship into an LLC, it’s essential to ensure that any previously registered business names comply with state regulations to avoid any potential legal challenges. This often requires canceling former Doing Business As (DBA) registrations.

A well-crafted strategy recognizes that an LLC and a trademark, though serving unique functions, complement each other seamlessly. The LLC secures the business framework while the trademark builds and protects brand equity. This dual approach creates a robust platform for growth and sustainability, encouraging the owner to innovate and enhance business value.

Thus, business owners should actively evaluate their plans through the lens of these legal structures. Assess the potential for growth both locally and nationally. For operations that are limited to state-level engagement, the protection provided by state LLC registration may be sufficient. Conversely, those with aspirations to expand must prioritize trademark registration alongside their LLC formation. Engaging with a legal professional who specializes in business law can illuminate potential pitfalls in both realms, ensuring that the foundational aspects of liability protection and brand identity are secure and strategically aligned.

Understanding the interplay between LLCs and trademarks is not merely an academic exercise but a vital component of a well-rounded business strategy that can significantly influence long-term success. By carefully navigating this legal landscape, businesses can forge a path toward resilience and recognition in today’s competitive marketplace.

For further insights on trademark registration and its impact on your business’s brand identity, consider exploring helpful resources that detail the process and benefits of intellectual property protection.

2. Navigating the Financial Landscape of LLCs and Trademarks for Optimal Business Growth

In the complex world of business development, understanding the economic implications of forming an LLC (Limited Liability Company) versus securing a trademark is vital for strategic planning and long-term success. Each serves unique protective roles that extend beyond legal limits into the financial viability of the enterprise. While an LLC primarily seeks to secure personal assets from business liabilities, a trademark focuses on safeguarding a brand’s identity, an often underappreciated yet critical asset that directly influences market presence and growth potential.

The formation of an LLC is not just a legal requirement; it represents a foundational step toward financial security. By establishing a legal entity, owners can limit their liability for business debts and lawsuits, effectively shielding personal assets such as homes and savings from creditors. This protection is crucial, especially for small businesses prone to financial risk. However, it is important to note that the name protection granted by an LLC is limited to the state of registration. This means while the name can be exclusive within that state, it offers no protection against non-LLC entities or businesses operating in other states, potentially exposing the brand to complications as it seeks to grow.

On the other hand, the economic value of a trademark lies in its dual ability to provide brand recognition and exclusivity on a national scale. Registering a trademark with the United States Patent and Trademark Office (USPTO) grants businesses exclusive rights to use their brand names, logos, or symbols in connection with specific goods or services throughout the country. This exclusive right is a powerful asset, deterring competitors from using similar branding that could confuse consumers or dilute the brand’s value. Moreover, trademarks can appreciate in value, turning into profitable assets that can be licensed or sold, thus opening additional revenue streams.

When assessing the costs involved in maintaining an LLC versus a trademark, entrepreneurs must consider both initial and ongoing expenses. Forming an LLC typically entails state filing fees that can range from $50 to $500, depending on the state, along with potential additional costs for registered agents. These are often viewed as manageable and necessary expenses for securing personal liability protection. Conversely, the costs associated with trademark registration are usually higher, with USPTO filing fees starting at $250 to $350 per class of goods or services. Additional expenses—including attorney fees for searches or applications, and maintenance costs like renewals every ten years—can escalate quickly for emerging brands aiming for national recognition. Although initial investments in trademarks may seem steep, the long-term risk mitigation and potential for value creation often justify these costs.

Furthermore, entrepreneurs must weigh the risks of foregoing trademark protection. Without it, businesses can face costly rebranding processes and the loss of market share if competitors infringe on their rights. This is especially relevant during periods of expansion; as businesses venture into new markets, not having a trademark can lead to disputes that not only drain resources but also disrupt brand continuity. An LLC can protect operational shields, but a trademark truly secures an identity, which is essential for scaling beyond state lines.

A combined strategy that incorporates both LLC formation and trademark registration proves to be the most prudent approach for businesses seeking long-term stability and growth. The LLC will manage business structure and liability, while the trademark acts as a formidable guard against brand infringement, thereby nurturing brand equity as it develops. As companies mature and possibly increase their product lines or services, utilizing state trademarks can offer additional layers of local enforcement, although federal protection should be the priority for businesses aiming for economic scale across interstate boundaries.

In conclusion, the nuances of choosing between an LLC and a trademark are crucial considerations in strategic business planning. For startups, the priority might lean towards setting up an LLC for immediate liability protection while deferring trademark registration until cash flow stabilizes. As a business grows, investing in a trademark becomes imperative—not only for protecting against future infringement but also for enhancing the overall market value of the company. Ultimately, understanding these financial dimensions empowers business owners to navigate their economic landscape adeptly, ensuring both legal security and robust brand identity.

For more insights on the role of trademarks in business strategy, you can check out this helpful resource on trademark protection.

Final thoughts

Understanding the differences and strategic advantages of LLCs and trademarks is essential for business owners. While LLCs provide a shield for personal assets against business liabilities, trademarks help in establishing a unique brand identity and prevent unauthorized use. By integrating both into your business structure, you can ensure comprehensive protection that supports growth and sustainability. As you move forward, consider how these elements can work together to fortify your business foundation.

Your IP is the foundation of your success – let’s protect it together before it’s too late. We can’t wait to help you turn your ideas into legally secured assets.

About us

At trademark2go.com, we’re your go-to partners for simplifying trademark, patent, and copyright registration. Our team of IP experts cuts through legal complexity, avoids common pitfalls, and delivers personalized guidance – whether you’re a startup, inventor, or creator. We prioritize your goals, turning your ideas into legally secured assets with clarity and care. Let’s protect what drives your success, together.